On Thursday, October 19, 2017, it will be the 30th anniversary of the biggest one day drop in the stock market. I was but a tween at the time, but I remember the day because my father followed the stock market religiously. He had this look of relief in his eyes.

Relief?

Yes, relief. He had sensed a drop was coming, after a 5 year bull market. The Case-Shiller Adjusted PE of the market at the time was hovering between 17 and 20. He sold out during the summer and waited for a drop. He got his drop.

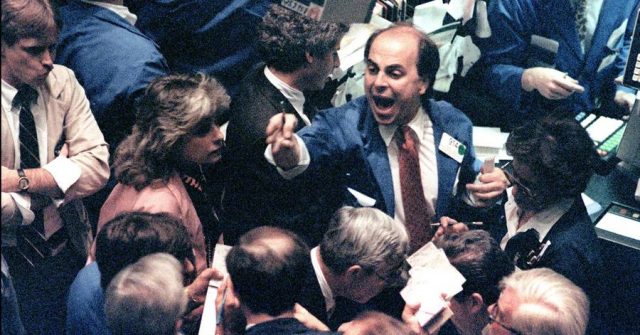

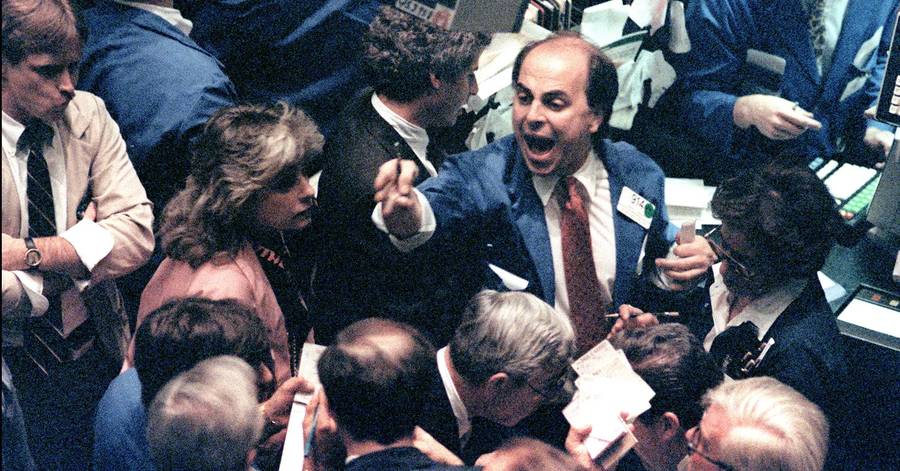

The drop was attributed to computerized stop orders which cascaded into a waterfall of selling, computerized or otherwise.

Amazingly, if you had bought the day before the crash, then 12 months later in 1988, you would have still made money. The drop basically was erased over the next 12 months. If you had bought after the crash, you would have made huge money. You can bank on people selling low after buying high, for fear of stocks going lower.

No, I’m not arguing for market timing. Nobody can time the market, no matter how much success they claim in Facebook and Twitter posts. But when individual securities have PEs of 30-50 (invert the PE to get your yield on investment; i.e. PE of 30 is 1/30 or 3.33% EPS return on investment), it makes sense to lighten up on those stocks and convert more of your investment to cash. You may lose out on future appreciation, but you may save yourself from a future correction.

Value investing adherents go by the motto: be greedy when others are fearful. However, many don’t know what to do with the other half of the sentence: be fearful when others are greedy. Do you just not buy? Do you sell? Do you start a blog and complain about absurd stock valuations?

I was recently asked what my stocks/cash ratio was. I am basically 90% in cash. Yes, you should have seen the man’s mouth drop. He couldn’t believe that JeeMoney, who touts stock market investing, has essentially dropped out of the market.

At Mohnish Pabrai‘s annual meeting for his hedge funds, he said he cannot find any compelling valuations in the US stock market. His latest 13-F shows just 3 US stocks in his portfolio.

I, too, am having a hard time finding anything worthwhile in buying. If you find any compelling stocks, let me know.

The stock market crashed 30 years ago. The Dow dropped 22.6% on Oct. 19, 1987, what became known as Black Monday, logging its biggest-ever decline. Black Monday was in many regards emblematic of a new era for financial markets.

Source: Dow’s Dance With 23000 Comes 30 Years After Black Monday